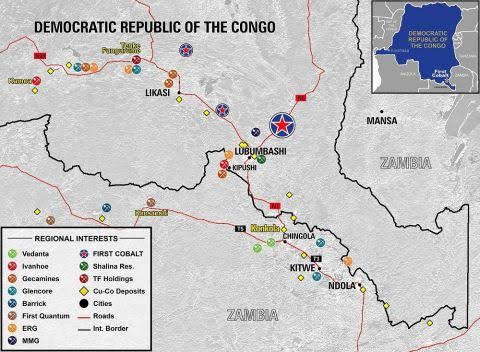

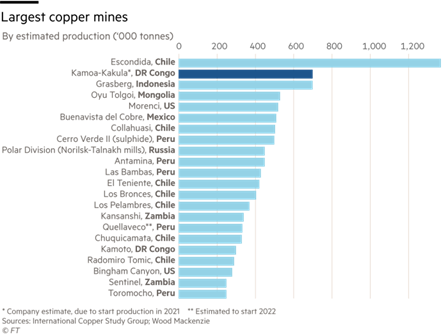

| The DRC is a "geological scandal" in terms of its vast and diverse mineral resources (copper, cobalt, coltan, gold and diamonds). The world's leading producer of cobalt, a strategic raw material for the automotive industry, the DRC is also a major player in copper (Africa's No. 1 producer) and gold. |

The mining sector remains at the heart of the Congolese economy

The mining code of 2002, inspired by the World Bank and designed to attract foreign investment, has encouraged the rise of the mining sector. Over the past 10 years, the mining industry in DR Congo has been one of the most dynamic in sub-Saharan Africa. Despite a difficult operating environment (water and electricity supply difficulties and poorly performing ore evacuation infrastructure), the abundance of mineral resources has largely accounted for the industry's good performance.[1] a sector that contributes more than 80% of the country's export earnings.

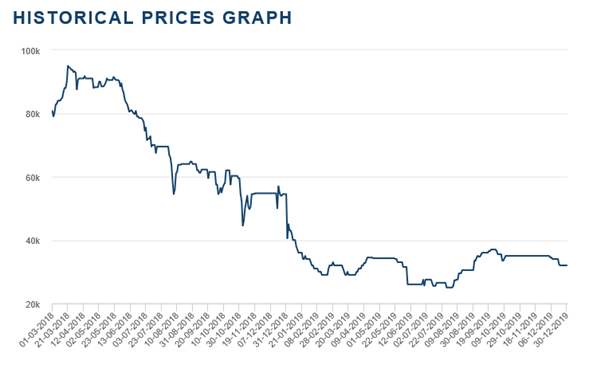

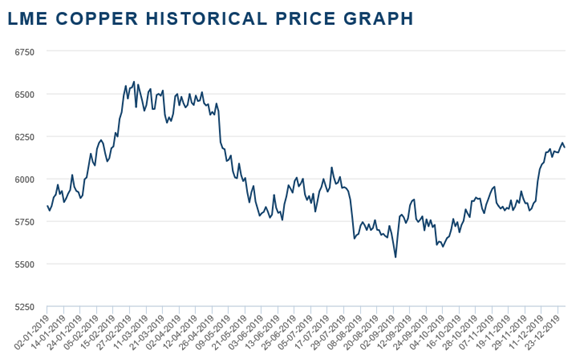

The reversal in the commodities cycle and the subsequent rebound in world prices in 2017 (copper: +60% to 7100 $/t, cobalt : +125.98 % 71000 $/t and gold +20% to 1300 $ per ounce) has encouraged growth in production volumes (+9.3 % for copper, +18% for cobalt, +13.3 % for diamonds and +5.7 % for gold). Only oil production remains on a downward trend (-4.8 %). During the first quarter of 2018, copper prices, which remain high, fell slightly (-3% or 6990 $/T). Over the same period, prices for cobalt, a strategic raw material for the electric car battery industry, continued to rise sharply (+39%, from 71000 $/T to 97000 $/T). Global demand for this mineral, for which the DRC is the world's leading producer (60% of global supply), is very strong and set to rise in the long term, given the needs of the automotive industry, where demand could rise from 90,000T/year to 122,000T/year by 2025.

The economic downturn in 2019

2019 was marked by falling copper and cobalt prices[2]. Cobalt prices have continued to fall steadily throughout 2019, falling by a factor of 3 between the peak reached in March 2018 (95,000 $/t) and current prices (32,000 $/t). Copper prices have also fallen in stages, from 6,500 $/t in February to the symbolic 6,000 $/t mark at the beginning of the summer. At the end of December, world copper prices stood at 62,001 $/t.

In terms of production volumes, production continued to rise over the first 6 months of the year (+3% for cobalt and +11% for copper). The outlook for production is more mixed. Several major mining projects are currently under development (Ivanhoe's Kamoa-Kakula project), as is Alphamin's tin mine project. Conversely, a number of major mines have indicated that they are considering scaling back their operations or are in the red (Tenke Fungurumé mine). Glencore announced the suspension of production at its Mutanda mine. This temporary stoppage is due to the exhaustion of oxide ores and the switch to sulphide ore mining, which requires a different processing technology and an investment of around €500m$. This suspension of production at the world's largest cobalt mine (Mutanda) comes at a time of tension between the major mining operators and the government. It is expected to have a direct impact on government revenues over the coming months. The World Bank estimates that the closure of this mine will automatically worsen the balance of payments by 2 points of GDP. The BANRO Group, one of the leading gold mines, has decided to suspend production in South Kivu and Maniema due to the security situation following rebel attacks on several of its sites.

Mining revenues have been impacted by this slowdown. The tax regime applicable to the mining industry provides for payment in instalments of taxes due in 2019, based on income for 2018. At the current price of cobalt, the payments made by miners in the form of advances should therefore be much lower, and therefore result in tax credits, i.e. as much less tax revenue for the State in 2020. Mining tax revenues accounted for 37% of government revenues, or 1.6 Mds$ in 2018. These revenues, which are highly dependent on the performance of the mining sector, are set to decline mechanically, even though the advances on tax revenues granted by the major mining companies have already used up much of the State's room for manoeuvre, and foreign exchange reserves remain low (1 week of imports). With the fall in prices, mining production generated growth of 4.5%, lower than in 2018 (+ 5.8%).

The 2018 Mining Code

The 2002 mining code was deemed to be very favourable to the mining industry. The new mining code, promulgated in March 2018, is less so. Major foreign companies established in DR Congo[3] tried to oppose some of the measures adopted, in particular the removal of the "stability clause". This clause provided for taxes to be maintained at their initial level for a period of 10 years. For the industry, this clause was justified by the amortisation of the very heavy investments made in the sector (10 billion$ according to the industry). Removing this clause would create tax instability that would be detrimental to the climate for future investment in the sector.

The new code, supplemented by implementing regulations, provides in particular for :

- the removal of the 10-year stability clause, now limited to 5 years;

- an increase in the Congolese state's stake in the operating companies, from 5 to 10% ;

- recalculation of royalties by increasing the rates on ores from 2.5 to 3.5%, and up to 10% for strategic ores such as cobalt;

- the introduction of a 50% tax on superprofits when commodity prices rise by more than 25% compared with the forecasts made in the feasibility study;

- less advantageous tax treatment, increased obligations to repatriate currency,

- subcontracting opportunities limited to legal entities governed by Congolese law and with Congolese capital.

Local content and the law on subcontracting

The authorities want to encourage the local recovery of minerals through local processing. So far, the new mining code has mainly had the effect of crystallising the discontent of the major operators. In future, they will have to abide by the new rules of the game, such as a production sharing as is the case in the oil industry.

To boost the local processing of minerals, in 2017 the authorities also adopted an law on subcontractingThe Regulatory Authority was officially launched in October 2019. Article 6 of this law states that "Subcontracting is reserved for Congolese-owned companies promoted by Congolese people". aims to give more space to Congolese companies in a sector that is still not very inclusive.

APPENDICES

Cobalt price, March 2018 - calendar year 2019

Source: London Metal Exchange (LME)

Copper prices, Calendar year 2019

Source: London Metal Exchange (LME)

Source: International Copper Study Group; Wood Mackenzie